December 1, 2024 by Ewell Smith

Alex Little: Niche Expertise, Cash Flow Fixes, and Money Mistakes Contractors Must Avoid

3 takeaways on this episode of the Close The Deal Podcast:

👉 Cash Flow Mastery: Cash flow forecasting and proper bookkeeping are essential to avoid financial pitfalls and improve decision-making.

👉Niche Expertise Wins: Specializing in a specific industry—home services, construction, and real estate—creates a unique advantage and fosters deeper client connections.

👉 Process Optimization: Simple process changes, such as improving invoicing systems and enforcing purchase orders, can transform businesses from near-bankruptcy to profitability.

Alex's insights could just save your businesses from going out of business needlessly...and increase your cash flow in the process.

Visit Alex Little's Website:

Close The Deal Podcast Player

Close The Deal Podcast with Alex Little

Founder - Little Financial

Full transcript with Alex Little - Close The Deal Podcast

00:00.35

ewellsmith

All right disruptors, I got a very special guest his name is Alex Little he is the founder of Little Financial Alex You're based out of Tampa. I want to welcome you to the show from New Orleans. We both have something in common Unfortunately, and it's called hurricanes and you just came you you just made it through a hurricane, but welcome to the show

00:21.67

Alex Little

and Thank you for having me.

00:23.44

ewellsmith

Yeah, so um you all did okay in where you are in Tampa, but a lot of a lot of people along your coast took a hit. And you know in in Louisiana, we we pay attention to that. I've i've been through, um well, since Katrina.

00:39.03

ewellsmith

I've had them as a child, but Katrina's the first one that was kind of like my landmark, the the benchmark you could say for for hurricanes and having dealt with it.

00:51.89

ewellsmith

So I understand understand the process. And that's part of business, right? Whether no matter where you're in business, you need to ah adjust for events. And sometimes people put themselves in financial crisis unnecessarily.

01:00.90

Alex Little

I think if I could do it over again, I would probably have started sooner of

01:04.89

ewellsmith

So we're gonna talk about how to prevent That that's a crisis that doesn't need to happen. But before we get started, what is one thing? First of all, welcome. I'm glad to have you. And what is one thing that you may have done differently when you were starting up your business?

01:23.64

Alex Little

i think if i if i could do it over again i would probably have started sooner of marketing and getting more invested in my local community because I started my business at the same time of just moving or moving back to Florida.

01:34.43

ewellsmith

Uh,

01:40.91

Alex Little

So I didn't really know anyone in the area and I have a virtual firm so like I can work with anyone across the United States. So I was doing that national marketing type of deal and just the the the mindset of a lot of people with like they their accountants and the financial advisors there's There's a lot of people that still like that local touch, you know, someone close to them that they can you meet in person if they have to.

02:03.60

ewellsmith

huh

02:07.99

Alex Little

And I think getting more invested in that sooner probably would be my biggest change.

02:13.03

ewellsmith

Well, that's ah that's ah that's an important point. because I always say when you start in a business, ah whether it's promotions or marketing, you start in your backyard. you know and that And that makes sense. It makes all the sense in the world. Well, we're going to help people also address some other things they shouldn't do or maybe should do better or a different way in a second. One more question before we jump into that. Who or what are you grateful for that helped you get to where you are today?

02:38.89

Alex Little

um I would say a gentleman by the name of Michael King. He has a ah course basically teaching people, either accountants or fractional CFOs, how to scale a fractional CFO firm because I started my firm as a fractional CFO only. I didn't have the accounting and tax side of my practice like I do today.

03:01.40

Alex Little

um and that course really helped me have a great like foundation for a framework for how the structure of my my business and a good i idea on scope of services.

03:14.15

Alex Little

because that's Especially with in the accounting world too. Scope of services and just saying yes to anything the client wants you know want to to do is really a big problem.

03:21.95

ewellsmith

yeah

03:24.48

Alex Little

So having that framework of this is what's worked for him in the past and this is how he's doing things.

03:25.70

ewellsmith

Yeah.

03:30.58

Alex Little

like that framework which is such a ah huge boost to you know learn years of experience in just you know a few hours basically.

03:37.82

ewellsmith

and That makes a sense. And that's the beauty of mentorship. I'm a huge proponent of mentorship. And that's what he's, he he said he has saved you thousands of hours of work, probably. All right. and we and And you're going to be a mentor to probably a lot of people in the service industry, because you have and you are an accountant, but you in your service, financial services, are very unique.

03:57.83

Alex Little

but

04:01.02

ewellsmith

You found a niche that covers three areas. What what are those three areas? And why did you do that?

04:08.33

Alex Little

Yeah, so the specialties from my firm and me personally are home services, construction, and real estate.

04:14.92

ewellsmith

OK.

04:15.75

Alex Little

And I did that mainly because that's my experience that I have.

04:20.53

ewellsmith

yeah

04:22.16

Alex Little

From a young age, I was taught by my dad to like you know be involved in real estate investing. And I've worked for real estate investment companies. property management companies. So I had that background. And then one of my side businesses that was doing lead generation marketing was focused on doing that for home services businesses. So carpet cleaners, pool maintenance, stuff like that. So I kind of learned, you know, not the ins and outs of all those businesses, but like a general idea of a lot of how they operated so they could market for them properly. And then with the construction, I kind of tripped into that one. One of my best friends

05:00.08

Alex Little

he was He became a CEO of a custom home building company and a renovation company and they were struggling. And actually right after I started my firm, they asked me to take over the accounting for them.

05:12.62

Alex Little

They were my first accounting client and I was working like 50, 60 hours a week on their business alone. I didn't really grow my business for about like eight months of my my starting out.

05:22.50

ewellsmith

Mm hmm.

05:26.74

Alex Little

Um, but I learned, you know, uh, how a general contracting company, custom home builder, you know, operated in and out. And, you know, I didn't, I never intended to use that as one of my industries, but I was like, Oh, I've learned so much over the past eight months.

05:36.00

ewellsmith

Mm hmm.

05:41.85

Alex Little

It would, it wouldn't make sense to not use, um, you know, that knowledge to to help other people.

05:48.33

ewellsmith

And I think it's important people understand in your background, right? Because you found you laser targeted in on a niche. There's a lot of accountants. My accountant serves as a whole, my bookkeeper serves a whole slew of industries. But I don't know that he's laser targeted one, which is what those three areas kind of come together.

06:08.93

ewellsmith

And that makes you unique. In fact, that would make you unique the fact the way you dress. Because I mean, if you talk to countless people thinking buttoned up suit, right, but you speak in the language, you can speak the language to the people in the industry. And let's talk about the five biggest mistakes you see people in the home services ah fall, the traps that they fall into that they can avoid.

06:33.84

ewellsmith

to help them become more profitable, have better cash flow, et cetera. And home services, how do you define home services? I mean, you get the you got the commercial, you got the construction side, you got the real estate.

06:47.47

ewellsmith

Home services, everything from roofing to, you mentioned carpet cleaning, painters, ah is that how you?

06:52.92

Alex Little

like So I would say home services, anything where they come to your home. So that would they also have include like a moving company, because it's like not a fixed location, they come to you.

06:58.77

ewellsmith

yeah Okay, okay. Okay.

07:04.35

Alex Little

So like maybe pool maintenance, that could be carpet cleaning, and pest control, moving companies, anyone that comes to you, like a maid service that comes to your house.

07:04.62

ewellsmith

gotcha Gotcha.

07:14.04

ewellsmith

Okay.

07:14.72

Alex Little

So like, there's a lot of overlap between home services and construction, because you could say HVAC and plumbing or home services, like that can also be you know a construction site too.

07:20.75

ewellsmith

Sure.

07:24.62

ewellsmith

And I think there's so many mom and pop businesses too out there. I mean, I'll work with a lot of franchises and in the home for in the home service sector, And you know a lot of them, when they're starting out, they will help their new franchisee with the books on the backside because they realize how critical that is.

07:44.37

ewellsmith

And they help them prevent some mistakes. Well, you there are thousands and thousands of more people that are independents in the marketplace in every city across the United States. And that's the issue.

07:55.14

ewellsmith

We're going to address five of the biggest mistakes that you see on a regular basis that they can avoid and how to avoid them.

07:56.03

Alex Little

Hmm. Hmm.

08:03.48

ewellsmith

So you want you want to where would you like to begin with those? get got You got a few in your deck of cards right there.

08:06.78

Alex Little

Yeah. And yeah, i've i've I've got a lot, but we'll just do five for today. And, uh, the top ones I can think of a couple of them might be like contractor specific, uh, for more construction side, but we'll, we'll go through it.

08:14.15

ewellsmith

Okay.

08:19.96

ewellsmith

That's fine.

08:22.81

Alex Little

So one that applies to every business and it's usually, it's like 90% of the reason why most people come to me originally is for like lack of cashflow forecasting.

08:33.90

Alex Little

They just don't know you know the things that keep them up at night. You'll ask small business owners and they'll say, oh, like it's my marketing. I need help with this. But like what keeps them up at night, really, is their finances. like Can I make payroll in two weeks? Can I afford to hire this new employee, et cetera? um And the biggest thing is it's very simple. like I have a free cash flow forecasting tool that I send out to people that I talk to. you and It's really just putting in like when you expect to receive cash from your your clients, your customers, and then have all your expenses, you know, below that of cash outflow, like when the cash actually leaves the door.

09:08.52

ewellsmith

Mm hmm.

09:16.43

Alex Little

And that can help you in so many ways. Cause like the biggest fear is the the unknown and knowing when, you know, cash is coming in out and like where you might be out of money.

09:21.16

ewellsmith

Yes.

09:28.32

Alex Little

Like knowing that weeks or days ahead, you know, if you're that far or months ahead, like that is a huge tool to not only know your financial situation, but also be able to scenario plan and like see if I can afford a new piece of equipment or whatnot.

09:42.25

ewellsmith

Yeah, and and and cash flow is the lifeblood of every business without it.

09:44.54

Alex Little

Cash is king.

09:46.67

ewellsmith

That's the problem.

09:47.34

Alex Little

Yeah. And a second one I'd actually add that is is on is on on top of that is that

09:47.84

ewellsmith

Cash is kidding.

09:58.47

Alex Little

Revenue doesn't equal cash. I see a lot of people that they, like the the question is always, um, they're making money, but they feel broke. And it's because they see, like they look at their P and L and they're like, Oh, look, I'm making so much money. I've sold so much stuff, but then they look at their bank balance and it's still low. And they're like, where's all my money gone? One of the biggest problems is that just because you invoice for something,

10:24.78

Alex Little

doesn't mean that money just all of a sudden shows up in your bank account. like You still have to collect it. And there's a lot of, I can i can bet you that most small businesses can look in their their QuickBooks or their accounting software, look at their outstanding accounts receivable, and they'll have invoices from like six months, one year, two year, three years ago that are still outstanding that they just didn't really know about.

10:39.71

ewellsmith

Mm-hmm. Mm-hmm. That counts receivable. Yep.

10:50.26

Alex Little

you know That's the biggest thing is, you know

10:51.14

ewellsmith

yes so

10:54.16

Alex Little

revenue is nice, but cash is king because it doesn't matter how much revenue you have if you never received the money for it.

11:01.43

ewellsmith

100%. All right. that you So you hit, you hit on the first one with a little bit of a bonus there. What's the second one?

11:06.98

Alex Little

So I would say that would probably be the second one is the, that it is such a huge thing, but number number three would be, um, anyone that does a project, um, estimating your project is so critical to, you know, making sure that you actually have a profit at the end of the day.

11:09.94

ewellsmith

Okay. Okay.

11:23.47

Alex Little

And a lot of contractors don't really think about all of the costs related to doing that project. And time and time again, they'll forget small little costs of like, oh yeah, we did spend like money on that little thing for that project. And they'll routinely be estimating projects that have like a 30% profit margin, but then when they actually go and if they do ever review the project afterwards,

11:52.86

Alex Little

it'll end up being like 17% because there was lots of costs that happen every project, but they just forgot to include it in their estimate or their estimates like a template that's out of date, you know, like keeping that up to date and including every single cost you could potentially use on that project is so critical to having a profit at the end of the day.

12:12.39

ewellsmith

how do you How do you advise them to capture that cost? What do you what do you what do you coach them on?

12:17.22

Alex Little

I mean, like the, the easiest way probably is just looking at, Um, all the costs that related to a project you've already completed and run through it and be like, you know, try and see our, are these costs going to happen again on another project?

12:32.64

Alex Little

Um, I just, that's the easiest way.

12:33.80

ewellsmith

Yep.

12:35.28

Alex Little

Um, you know, it's really hard when you're first starting out and you have no projects data to go off of.

12:40.08

ewellsmith

Mm hmm.

12:40.42

Alex Little

That's probably the easiest way of just looking at what happy spent money on in the past, um, to see like what's going to happen next project.

12:47.67

ewellsmith

Sure, sure. Okay. um And the next one's really important, it kinda ties back. Well, the next one's really important, the purchase.

12:55.67

Alex Little

Yeah. So, um, and this will be number four. So we'll have a bonus one, but number four is, um, not having a purchase order process.

12:59.69

ewellsmith

Yeah, yeah.

13:06.24

Alex Little

Um, if you deal with subcontractors or vendors that have, you know, you're getting materials from, so again, the kind of a contractor thing, um, a lot of contractors that I see.

13:17.77

Alex Little

They'll just come up with the estimate. They might get a bid from a subcontractor or, you know, materials provider, um, and use that.

13:22.24

ewellsmith

Hmm.

13:25.73

Alex Little

but then they won't hold they won't like create a purchase order and like have that actually be approved by the the vendor and hold the vendor to that cost.

13:35.60

ewellsmith

Hmm.

13:38.24

Alex Little

you know There's change orders if things happen type of deal, but like you should be going off of that because I see time and time again where a contractor will, if they do do purchase orders, will get a vendor to agree to ah an amount on the purchase order But then when they get the invoice from the projects done, um, they'll pay off the invoice and lots of times the invoice doesn't match the purchase order.

13:56.64

ewellsmith

ah

14:01.47

ewellsmith

Yeah.

14:01.64

Alex Little

Like you have to enforce that and you have to actually enforce that process because again, that estimated 30% profit margin can quickly come zero. If you're paying your your subcontractors, not the like more than the amount than you would estimate and agree to to start with.

14:16.14

ewellsmith

You agreed to it to start with.

14:18.54

Alex Little

Yeah.

14:18.84

ewellsmith

Yeah, that makes sense. And that's easy. That's so easy to over overlook. you know so it's ah

14:23.36

Alex Little

Yeah, no. Cause it's like, you just assume like, Hey, like this is the purchase order. This is what you said you would do it for. Of course the invoice is going to be it for that amount. And lots of times that's not the case.

14:34.44

ewellsmith

Yeah, that makes sense. All right. What's that what's the next one?

14:38.40

Alex Little

Yeah. Uh, number five would be using customer deposits for your, your company's operating costs.

14:42.52

ewellsmith

Mm-hmm.

14:45.75

Alex Little

Again, on the contractor thing, but let's say you get 10,000 deposit for a project. Well, like a small percentage of that is your profit. Like once you've actually started doing work on the project, but the majority of that should be set aside towards the materials and labor to do that project. Time and time again, I see people get a deposit and they're like, okay, this is my money now. And they spend it on their own payroll or on, you know, their

15:19.93

Alex Little

operational costs, SG&A, so general you know and administrative stuff, office expense, when it's like, okay, but then when it comes time to pay their subcontractors, they're like, oh, well, now I don't have any money because I spent my the deposit already that was supposed to be for that.

15:31.47

ewellsmith

Mmhmm. Mmhmm.

15:35.07

Alex Little

So the thing I tell people to remember is that if at any point in time, if the customer said, I want to end this contract with you, you are legally obligated to give that money back.

15:48.21

ewellsmith

Mmhmm.

15:48.94

Alex Little

And how much, you know, you need to give back is something you should have set aside because that's not your money to play with. It's just your money in your hand, and like their money in your hands that you're going to give to a subcontractor or vendor or whatever, but kind of.

16:02.72

ewellsmith

It's kind of like a Ponzi scheme. Borrowed using somebody else's with money. Yeah, I get it.

16:07.85

Alex Little

No. And like, that's why I saw a lot of times, like my, my friend's company, like when he first started, that's how they were kind of doing things is that they would take one customer's deposit and Like pay the last projects subcontractors and operating costs.

16:20.83

ewellsmith

Yeah.

16:23.25

Alex Little

And then they'd have to get another deposit from the, uh, you know, customer in order to pay for the next thing.

16:29.84

ewellsmith

And one little one little mistake and they got a hiccup and then they got a real fit.

16:30.02

Alex Little

Yeah.

16:33.48

ewellsmith

Then they go back to the cash flow prompts.

16:33.90

Alex Little

They're just kicking the can down the road in there. Yeah. So it's, it's a, it's a big problem.

16:40.03

ewellsmith

Well, that probably brings us to the last one.

16:40.92

Alex Little

Let's get started.

16:43.84

Alex Little

Yeah. So bonus number six will be just an emergency fund. And I know this gets brought up time and time again. People talk about it all the time. but And I've had this problem in the past, too, is that like you know it's true that a dollar a day is worth more than a dollar tomorrow. So like you always think, well, I can invest this in my business or do something with this, and I'll have more money tomorrow that's going to be more than that emergency fund, me just putting that dollar away in savings. But if you always do that, then you never have an emergency fund

17:17.72

ewellsmith

Yeah.

17:18.03

Alex Little

And sometimes, you know, there's lots of payments and expenses that you have that you can only pay in cash and times are tough.

17:20.95

ewellsmith

Mm hmm.

17:27.11

Alex Little

Um, and you know, bad things are going to happen all the time. Like, um, one thing that really sticks out to me is the movie, um, the big short, you know, about the 2008 financial crisis and the, the Brownfield fund.

17:37.38

ewellsmith

Mm-hmm. Mm-hmm.

17:41.92

ewellsmith

Mm-hmm.

17:43.56

Alex Little

they talk about like they got They started out with like a little bit of money and from family and friends, and they made so much money because they were they were betting on like these small risks that people ignore that they think never will happen. like Those small things, like a huge hurricane wiping out New Orleans, that like it's can happen. People don't think you're like oh that the risk is so low.

18:10.39

Alex Little

know

18:10.42

ewellsmith

Yep.

18:11.34

Alex Little

it Anyways, long story short, emergency funds, things it's gonna hit, like, stuff's gonna hit the fan and things are gonna happen at some point and having that gives you so much confidence and you should have anywhere from three to six months of operating expenses.

18:24.75

ewellsmith

ah so That's what I was ask you. how how much How much do you recommend?

18:27.14

Alex Little

Yeah. Three three months is is is is, it's not, I'd say minimal, but like also like acceptable.

18:31.08

ewellsmith

A medal.

18:36.09

Alex Little

Like six months is great, but realistically, most accountants and finance people

18:36.58

ewellsmith

Yeah. Yeah.

18:41.78

Alex Little

Don't expect the business to have six months of operating costs to the side.

18:44.82

ewellsmith

Yeah.

18:45.45

Alex Little

So three months is really the goal and then anything above that is awesome, you know, bonus points.

18:50.74

ewellsmith

So these are some critical things that can keep ah make make the difference whether a business survives or not.

18:55.65

Alex Little

I know.

18:55.79

ewellsmith

um How do you help your can your clients? when they come up Somebody's coming and into you in their books are a mess. You address these issues. You help them clean it up. And I know you've helped some businesses become very profitable too because all of a sudden they realize, oh, I'm just bleeding out money and that now I can fix it.

19:13.14

ewellsmith

tell Just give us a snapshot of how you can help your clients.

19:13.63

Alex Little

Hmm.

19:18.04

ewellsmith

uh correct some mistakes basic stuff really simple stuff that can be detrimental if they don't address it early on because it can only compound if it if it can't get like you said to use your words the can kick gets kicked down the road it can compound and cause a real crisis for them so we want to keep the people from getting in crisis the the the home services the construction guys real estate from getting in crisis um how do you help them and then we'll do a we'll uh i got one more question for you

19:46.44

Alex Little

Yeah. And like umll I'll use a good example. So one of my clients is a ah pool maintenance and construction client.

19:53.39

ewellsmith

Okay.

19:54.42

Alex Little

And when I first started working with him, his books were an absolute mess. this We started back in May of last year, last year, so 2023.

20:01.73

ewellsmith

Hmm.

20:05.69

Alex Little

And his books were a mess. He was thinking that he would have to declare bankruptcy because like he was in in his eyes in such a hole, he didn't see that he could be able to dig out of it. Well, after we cleaned up his accounting, I took a look at his kind of his process flow and just his tech stack of the software that he's using just on the finance and accounting side and simply just changing like the the software that he was using and the service that he was using to send out invoices and collect payments.

20:42.93

Alex Little

That completely changed, like it was a game changer for him. It solved so many cashflow problems. Cause he had, like I had mentioned, he had invoices that were out saying from 2021 that he didn't even know about it.

20:54.92

ewellsmith

wow

20:55.61

Alex Little

Cause he never took the time to look into that. And he didn't know that he had clients that still hadn't been from years ago. So looking at their process and figuring out like, what's a better way to automate this?

21:07.87

ewellsmith

Yep.

21:08.13

Alex Little

Um, and how can we, you know, send the invoice to the clients, get them to pay and then save you some money on that. Um, and we, we took him from near bankruptcy to the first half of this year for those from January to June, he had made like 260 grand plus in profit.

21:25.75

Alex Little

So the bankruptcy to that, like, and that was just from some process changes, you know?

21:25.85

ewellsmith

There you go.

21:30.31

ewellsmith

Just a fundamental, that's the that's why I'm trying to drive home is the fundamental things can mean the difference of going out of business or having a $200,000 profit within a matter of six months.

21:33.46

Alex Little

Yeah.

21:38.79

Alex Little

one Yeah.

21:42.05

ewellsmith

So anybody in the home service sector needs to pay attention. um One last question for you is what's your number one piece of guidance it ah that you help, that that you would recommend to folks but that are in their own business or going into business?

21:57.81

Alex Little

Yeah. um It's kind of a tie between the cash flow forecasting and just having good books because you can't have a cash flow forecasting without good books.

22:04.95

ewellsmith

Yeah.

22:07.75

Alex Little

That's why I started as a fractional CFO and started the accounting and tax side of my business.

22:07.84

ewellsmith

Yeah.

22:11.70

ewellsmith

Gotcha.

22:12.35

Alex Little

There's so many people that thought their bookkeeper was amazing. I take a look at their books and this is a dumpster fire. I can't give you any type of forecasting or advice if I don't know if you're profitable or not.

22:17.57

ewellsmith

Yes.

22:22.46

Alex Little

So what it really comes down to is

22:22.52

ewellsmith

That's right.

22:25.29

Alex Little

If you want to make good decisions, you need good data. And in order to do that, you have to have clean and accurate books and like being informed and knowing how your business is doing financially right now helps you make better decisions and better financial decisions going forward.

22:41.05

ewellsmith

That's great. And then you can also coach them on the best tech stack, best tech tools to use specific to their industry, to their business.

22:46.42

Alex Little

Yeah. That's, that's one of the biggest areas that like my business, my firm stands out as we're not a traditional accounting firm doing things the old way.

22:56.01

ewellsmith

Okay. Gotcha. Yes.

22:59.10

Alex Little

Like I'm very tech forward. You know, AI and automation is like our, the name of our game for our firm.

23:06.11

ewellsmith

That makes sense. All right. How do people get in touch with you ah so they can so say they they need to clean up their books or prevent some problems from happening? How did they get in touch with you?

23:16.15

Alex Little

Yeah. The, the two easiest ways is going to a www dot.little- financial dot com so lilhiphenfinancial dot com or just finding and reaching out to me on LinkedIn, Alex Little.

23:25.49

ewellsmith

Gotcha.

23:30.19

Alex Little

I think my like um yeah URL is like the linkedin dot.com slash I am Alex Little because apparently there's an Alex Little already out there um and that's the two best ways.

23:37.69

ewellsmith

Yep. Yep. Well, we will have, I'll have the folks, I'll have the hot links to his website and to his LinkedIn on our landing page for you, Alex. I'll have that set up. And I want to thank you for your time. You can help a lot. One episode like this can help hundreds of businesses, uh, stay profitable and not go out of business and increase their profits for that matter too. So I appreciate you Tom.

24:06.66

Alex Little

Indeed. Thanks for having me on.

24:08.16

ewellsmith

All right, so thank you.

Subscribe

Be The Boss.

Your Gift For Visiting: Grab A Copy of Your First Franchise Roadmap

Close The Deal Leveraging

Multi-Unit Franchising. Click here.

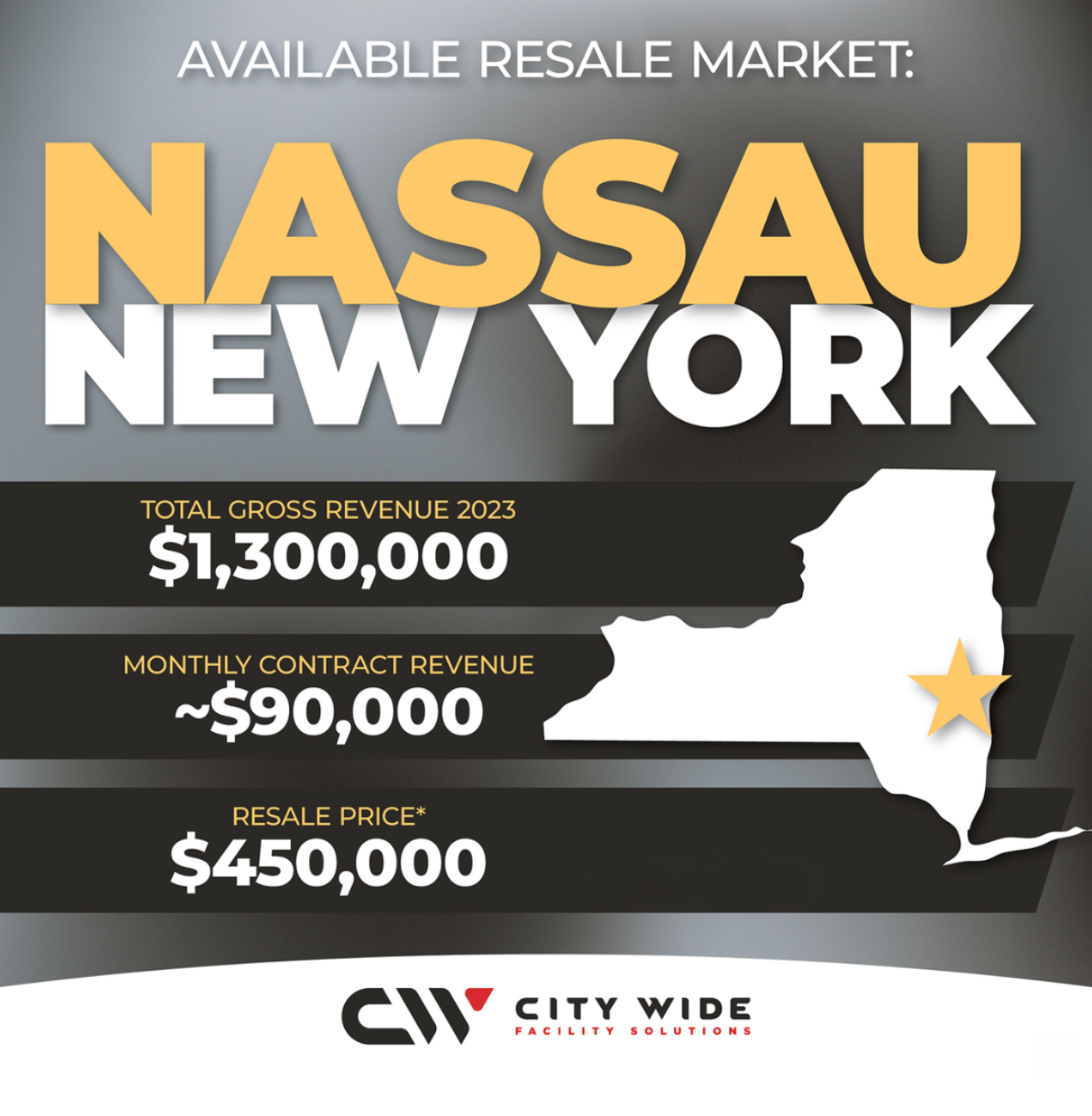

Close The Deal Resales:

City Wide Franchise - Real Estate Management

Nassau, NY

- Total Gross Revenue 2023: $1,300,000

- Number of Employees: 2 (1 Account Manager, 1 Night Manger)

- Resale Price is $450,000 (includes $120,000 initial franchisee fees)

Top 10 Close the Deal

Franchise Resales

January 2025

Waggles Puppy Boutique - Roanoke , Virginia $425,000

Window Genie - San Antonio, Texas $300,000

Zoom Room - Huntington Beach, California $500,000

1-800 Radiator & AC - Amarillo, Texas $1,200,000

AdvantaClean - Bethel, Ohio $570,000

All Dry - Houston , Texas $430,000

AlphaGraphics - S LA County, California $1,800,000

Barrel House - Coralville, Iowa $1,800,000

BFT - Richmond Heights (St. Louis), Missouri $430,000

Budget Blinds - Huntsville, Texas $500,000

Over 173 Franchise

Resales Available

Learn more about the opportunities above and discover other resale opportunities:

About The Author: Ewell Smith - Certified Franchise Consultant / Publisher - Close The Deal / Host - Close The Deal Podcast / Author - Your First Franchise Roadmap - Ewell serves aspiring entrepreneurs and Veterans considering a franchise. To learn more, contact Ewell.

New Paragraph