January 8, 2025 by Ewell Smith

6 Smart Paths To Fund Your First Franchise in 2025 That Will Get You Started Today

One of the things I love most about what I do is helping people realize that franchise ownership is possible for them.

The Myth I Bust All The Time That's Rooted to Financing

As a franchise consultant, one of the biggest questions I hear is, “How do I fund my franchise?” A lot of people assume franchising is out of their financial reach, thinking it’s a million-dollar investment. The truth? Most of the franchises I work with fall in the $85,000 to $285,000 range. Let’s bust that myth—franchise ownership might be a lot more attainable than you think.

It’s a fair question because the financial piece can feel like the most overwhelming part of the process. But here’s the good news: whether you’re leaving the corporate world or transitioning out of military service, there are several franchise financing options available that can help make franchise ownership a reality for you.

Two additional resources for you below:

- Two podcast interviews I did with leading franchise financing experts.

- A free gift for you - link to my new book - Your First Franchise Roadmap

Why Funding Matters

Before we get into the details, let’s talk about why funding is such a critical part of this journey. Unlike starting a business from scratch, franchising comes with some upfront costs—think franchise fees, equipment, inventory, and other startup expenses. Having a smart franchise funding plan helps you cover these costs and sets you up for long-term success.

It’s Possible...

Now, I know a lot of people think funding a franchise might be out of their reach. But the reality is, there are so many tools and programs out there designed to make this process more accessible than you might think. From small business loans for franchises to creative financing options, there’s a solution for nearly everyone.

6 Proven Paths To Fund Your First Franchise:

1. Personal Savings

Let’s start with the simplest option: your own savings. A lot of people prefer this route because it keeps things clean—no debt, no interest payments.

Why It Works:

- No loan applications or waiting for approvals.

- You maintain full control without obligations to lenders.

- No interest payments eating into your profits.

A Few Things to Consider:

- This requires having enough personal savings to comfortably cover costs.

- Make sure you don’t wipe out your entire safety net—you still need a cushion for life’s surprises.

2. Small Business Administration (SBA) Loans

SBA franchise loans are hugely popular among franchisees for good reason. They’re backed by the government, which means lenders feel more secure giving you a loan.

Why My Franchise Candidates Love Them:

- Lower interest rates compared to traditional loans.

- Longer repayment terms, sometimes up to 10 years or more.

- The SBA guarantees part of the loan, making approval easier.

Key Types for Franchisees:

- 7(a) Loan Program: Great for general business purposes, including buying a franchise.

- CDC/504 Loan Program: Focuses on bigger assets like real estate and equipment.

- SBA Express Loans: Faster approvals, though with lower borrowing limits.

If you’re going this route, make sure your credit score is solid (typically 650 or higher) and come prepared with a business plan that shows lenders why your franchise is a great bet.

My Interview with Dan Pace

Dan Pace, founder of First Financial, shares invaluable insights into SBA franchise loans. He also touches on the benefits of investing in real estate for franchises (beauty, retail, food, etc.) requiring physical space.

3. Veteran-Specific Programs

Veterans, you have solid options available to you. Franchising is a natural fit because the leadership and discipline you bring to the table are exactly what make franchisees successful. In my book, on page 137, I highlight ten key reasons why veterans excel in franchising.

Programs Worth Checking Out:

- VetFran Program: Offered by the International Franchise Association, this program gives veterans discounts on franchise fees and other perks.

- SBA Veterans Advantage: Cuts or eliminates fees on SBA loans for veterans and their spouses.

These programs are designed to make it as easy as possible for veterans to transition into business ownership.

In addition to these programs, many of the franchises I work with offer special discounts for veterans. One of the automotive brands I work with even waives the entire $45,000 franchise fee for veterans.

4. Franchisor Financing

Here’s a little-known fact: some franchisors offer their own financing options. It’s often more flexible than traditional loans.

Why It’s a Great Option:

- Financing for franchise fees, equipment, and startup costs.

- Payment plans tailored to match your business’s cash flow.

- Franchisors want you to succeed, so they’re invested in helping you get started.

Just be sure to read the fine print and compare their terms with other franchise financing options before committing.

5. 401(k) Rollovers (ROBS)

Most of the franchise candidates I work with had no idea using their 401(k) was even an option.

A Rollover for Business Startups (ROBS) is a creative way to use your retirement funds to invest in a franchise without paying early withdrawal penalties or taxes. All you’re doing is shifting the asset.

How It Works:

- Your retirement funds are rolled into a new 401(k) plan that invests in your business.

- You get access to capital without taking on debt.

Why People Choose ROBS:

- No monthly loan payments or interest.

- Keeps you in full control of your business.

That said, this is a more complex option and comes with compliance requirements, so make sure you work with a professional to get it right.

My Interview with Sara Vrancik

Sara Vrancik, a ROBS expert with Benetrends, breaks down how to use this strategy effectively. Benetrends pioneered the 401(k) rollover method, and Sara shares tips for getting it right.

6. Traditional Bank Loans

Traditional bank loans for franchises are still an option, especially if you have a strong financial history. While they might not have the same perks as SBA loans, they’re worth exploring.

Things to Know:

- You’ll need excellent credit.

- Be ready to offer collateral.

- Interest rates can vary, so shop around for the best deal.

- Having a solid relationship with your bank can make a big difference here, so don’t hesitate to build that connection.

My Gift To You

Grab Your Free Copy My New Book - Your First Franchise Roadmap

Here’s My Takeaway for You

If you’re thinking about franchising but the funding piece feels like a roadblock, let me reassure you: there are options. Whether you’re a veteran exploring veteran franchise programs, a corporate professional considering an SBA loan, or someone looking at creative financing options like ROBS or crowdfunding, there’s a path forward.

The key is to take it one step at a time. Let’s connect and talk about what makes sense for you. I'm happy to make a personal introduction to either Dan or Sara - both are superb at what they do.

Franchise ownership is closer than you think, and I’m here to help you get there.

Set Up A Quick Call

I’d love to learn what your passion is...your "why" for considering making a move. Many will never take this simple step to realize their dream of business ownership - this is your first step. So you know, I function much like an executive recruiter, meaning my time is covered by the franchisor; so there’s no cost to you. Here's the link toward being your own boss.

Subscribe

Be The Boss.

Your Gift For Visiting: Grab A Copy of Your First Franchise Roadmap

Close The Deal Leveraging

Multi-Unit Franchising. Click here.

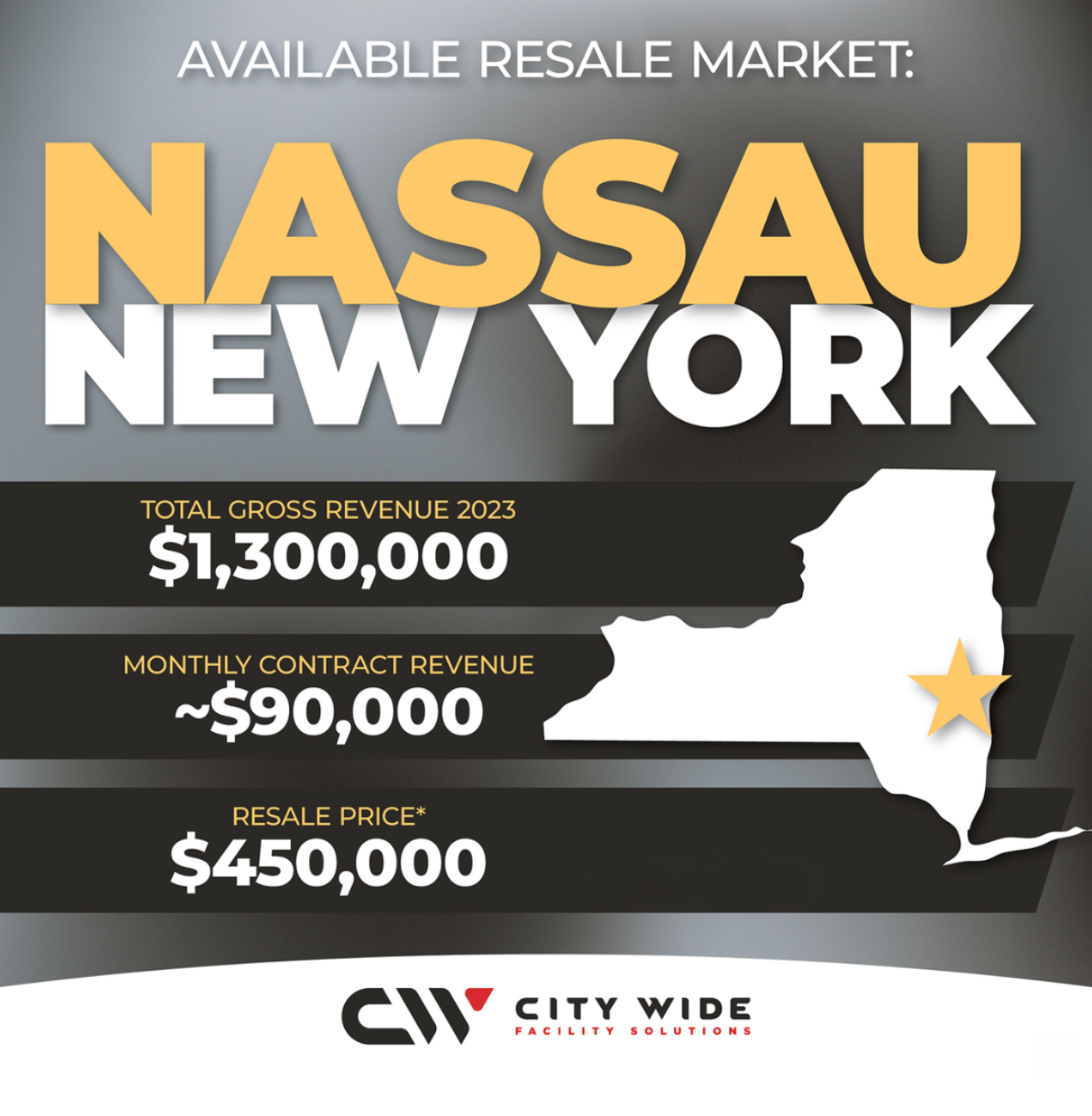

Close The Deal Resales:

City Wide Franchise - Real Estate Management

Nassau, NY

- Total Gross Revenue 2023: $1,300,000

- Number of Employees: 2 (1 Account Manager, 1 Night Manger)

- Resale Price is $450,000 (includes $120,000 initial franchisee fees)

Top 10 Close the Deal

Franchise Resales

January 2025

Waggles Puppy Boutique - Roanoke , Virginia $425,000

Window Genie - San Antonio, Texas $300,000

Zoom Room - Huntington Beach, California $500,000

1-800 Radiator & AC - Amarillo, Texas $1,200,000

AdvantaClean - Bethel, Ohio $570,000

All Dry - Houston , Texas $430,000

AlphaGraphics - S LA County, California $1,800,000

Barrel House - Coralville, Iowa $1,800,000

BFT - Richmond Heights (St. Louis), Missouri $430,000

Budget Blinds - Huntsville, Texas $500,000

Over 173 Franchise

Resales Available

Learn more about the opportunities above and discover other resale opportunities:

About The Author: Ewell Smith - Certified Franchise Consultant / Publisher - Close The Deal / Host - Close The Deal Podcast / Author - Your First Franchise Roadmap - Ewell serves aspiring entrepreneurs and Veterans considering a franchise. To learn more, contact Ewell.

New Paragraph