June 5, 2024 by Ewell Smith

Find out the best SBA franchise financing options for you to start fast.

Dan Pace, CEO First Financial, shares how you can make a real estate play if you're considering a brick and mortar franchise.

Dan shares 3 takeaways on this episode of the Close The Deal Podcast

(Your First Franchise Episode):

👉Value Bomb 1: Leverage SBA Loans

Dan highlights the importance of SBA loans for franchisees, especially the Express Loans (up to $150,000, no collateral) and Dream Loans (up to $500,000, flexible terms). These loans provide accessible and secure financing options for new and expanding franchises.

👉Value Bomb 2: The Power of Mentorship

Dan credits his success to mentorship, emphasizing that guidance from experienced entrepreneurs is crucial. He advocates for seeking mentors to navigate business challenges, echoing his own journey and his work with SCORE to mentor new business owners.

👉Value Bomb 3: Own Your Real Estate

Dan advises franchisees to consider purchasing their business property using SBA 504 loans. Owning real estate can lower costs compared to leasing, build equity, and provide additional rental income, making it a strategic investment for long-term financial health.

This episode is brought to you by YourFirstFranchise.com

Visit AG1 for your free one year supply of D3+k2 and five free travel packs of AG1

Close The Deal Podcast Player

Close The Deal Podcast with Dan Pace

CEO- First Financial

In this Close The Deal Podcast special episode of "Your First Franchise," host Ewell introduces his guest Dan Pace, the founder of First Financial, which specializes in financing for franchises.

Dan, who has a background in football and currently enjoys cycling, shares his journey from being an athlete to a financial expert helping entrepreneurs.

Dan opens the discussion by highlighting the importance of mentorship in his life, attributing much of his success to the guidance he received from family members and industry mentors. He emphasizes how his uncle Dino, a lifelong entrepreneur, taught him crucial lessons about business and finance.

Dan transitions into the core of the podcast, discussing the financial services offered by First Financial. He explains the company's specialization in Small Business Administration (SBA) loans, particularly beneficial for franchisees. Dan describes three main loan products: the Express Loan, the Dream Loan, and the Big Ticket Loan.

1. Express Loan: This loan, up to $150,000, is designed for working capital and is popular among new franchisees. It requires minimal down payment (around 10%) and has no prepayment penalties. The approval process is swift, typically within 24 hours, and funds can be available in 12 to 30 days.

2. Dream Loan: Ranging from $150,000 to $500,000, this loan also requires no collateral and is geared towards larger franchises or those needing more equipment. It includes interest-only periods and a down payment of 10-20%, with the franchise fee counting towards the down payment.

3. Big Ticket Loan: For amounts over $500,000, this loan is suitable for significant investments like buying buildings. SBA guidelines necessitate additional collateral, usually in the form of real estate. The loan is amortized over 25 years, making it feasible for large-scale projects and property acquisitions.

Dan discusses the growing trend of franchise resales and how these loan products facilitate such transactions. He also highlights the benefits of owning real estate for business operations, noting that it can often be more economical than leasing. SBA loans can be used to purchase properties, with the requirement that the business occupies at least 51% of the space.

Dan touches on the current high-interest rates, which are at a 22-year peak, and the anticipation that rates may decrease later in the year. Despite high rates, there hasn't been significant hesitation from entrepreneurs seeking to start or expand their businesses.

Subscribe

Be The Boss.

Your Gift For Visiting: Grab A Copy of Your First Franchise Roadmap

Close The Deal Leveraging

Multi-Unit Franchising. Click here.

Close The Deal Resales:

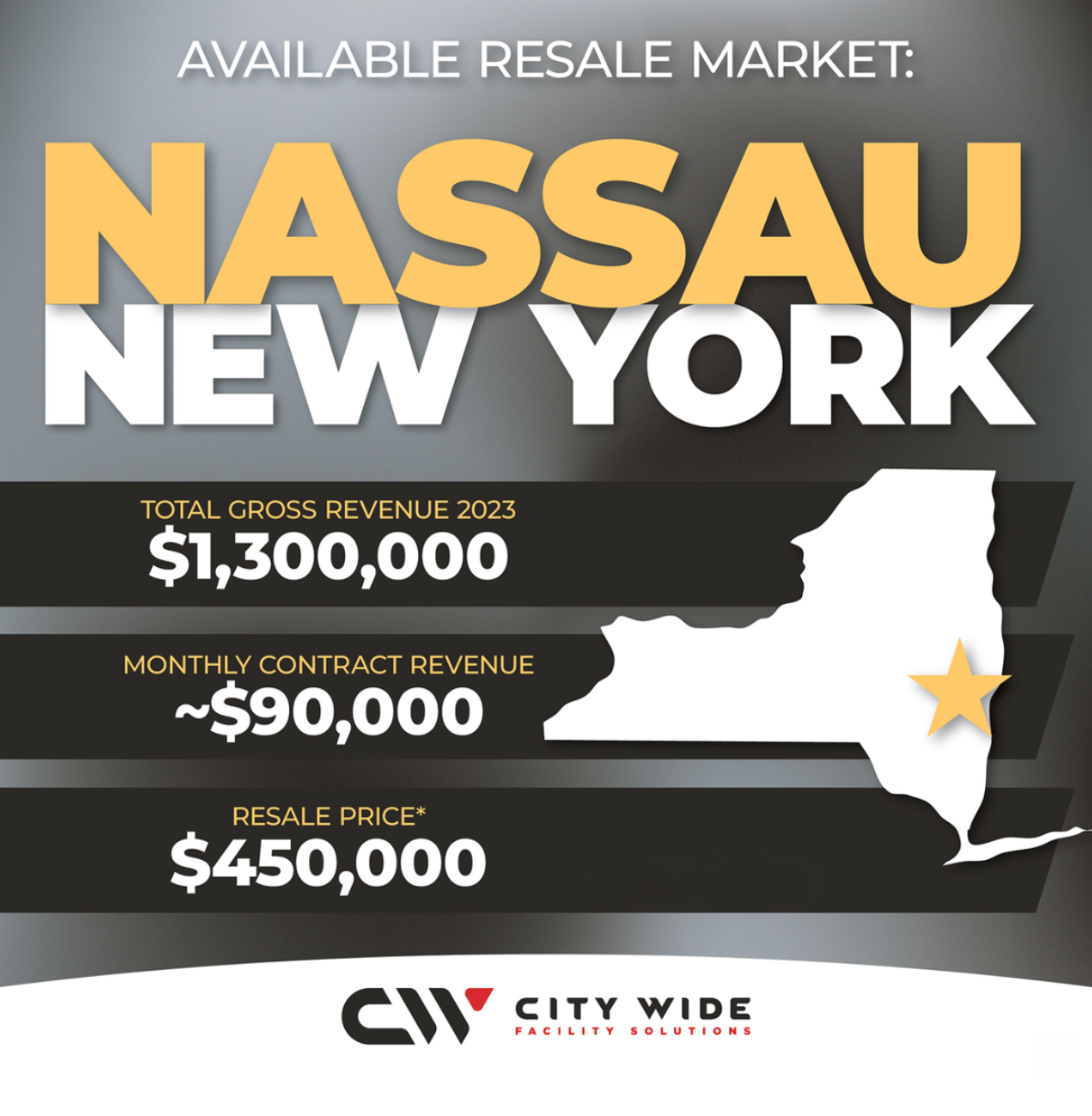

City Wide Franchise - Real Estate Management

Nassau, NY

- Total Gross Revenue 2023: $1,300,000

- Number of Employees: 2 (1 Account Manager, 1 Night Manger)

- Resale Price is $450,000 (includes $120,000 initial franchisee fees)

Top 10 Close the Deal

Franchise Resales

January 2025

Waggles Puppy Boutique - Roanoke , Virginia $425,000

Window Genie - San Antonio, Texas $300,000

Zoom Room - Huntington Beach, California $500,000

1-800 Radiator & AC - Amarillo, Texas $1,200,000

AdvantaClean - Bethel, Ohio $570,000

All Dry - Houston , Texas $430,000

AlphaGraphics - S LA County, California $1,800,000

Barrel House - Coralville, Iowa $1,800,000

BFT - Richmond Heights (St. Louis), Missouri $430,000

Budget Blinds - Huntsville, Texas $500,000

Over 173 Franchise

Resales Available

Learn more about the opportunities above and discover other resale opportunities:

About The Author: Ewell Smith - Certified Franchise Consultant / Publisher - Close The Deal / Host - Close The Deal Podcast / Author - Your First Franchise Roadmap - Ewell serves aspiring entrepreneurs and Veterans considering a franchise. To learn more, contact Ewell.

New Paragraph